Contents

A look back at last season

The 2024/25 Bundesliga ran from 23 August 2024 to 17 May 2025 and ended with Bayern Munich back on top. They clinched the title on 4 May 2025 with two matches to spare after Bayer Leverkusen drew 2–2 at Freiburg, sealing a record 33rd Bundesliga crown and 34th German championship overall.

Bayern’s campaign was commanding rather than cagey. They finished on 82 points with 99 goals scored, comfortably clear of Leverkusen in second on 69, with Eintracht Frankfurt third on 60 and Borussia Dortmund fourth on 57. That 13-point cushion underlined the gap at the summit.

There were strong storylines behind the numbers. Harry Kane won the Torjägerkanone with 26 league goals, while Leverkusen strung together a remarkable 34-match unbeaten away run that stretched into the final day.

At the other end, Holstein Kiel and VfL Bochum went down automatically, with Heidenheim dropping into the relegation play-off. European slots fell to Bayern, Leverkusen, Frankfurt and Dortmund for the Champions League, Freiburg and Stuttgart to the Europa League, and Mainz to the Conference League.

Off-season transfers: Who reinforced or reshaped their title push?

Transfer window timeline

Because of the expanded FIFA Club World Cup, Germany’s 2025 summer market is split in two: an early 1–10 June window, then the main window from 1 July to 1 September.

Bayern Munich: Targeted upgrades around a winning core

What they did: Bayern moved decisively for elite pieces. The headline is Luis Díaz from Liverpool on a deal to 2029 (fee widely reported around €75m), adding a high-end 1v1 threat to the attack. They also landed Germany international Jonathan Tah on a free after his Leverkusen contract expired, and tied up a pre-contract for teenage midfielder Tom Bischof (Hoffenheim) who now arrives. Out wide, Leroy Sané departed for Galatasaray.

Why it matters: Díaz + Olise gives Vincent Kompany two natural outlet wingers to play around Kane/Musiala, while Tah adds leadership and aerial security at the back. Bischof is a low-risk, high-upside depth piece. Sané’s exit trims wages and clarifies the wing rotation.

Bayer Leverkusen: Rebuilding the spine, especially in goal

What they did: With Jonathan Tah gone and major outgoings elsewhere, Leverkusen refreshed key lines. They signed England U21 centre-back Jarell Quansah from Liverpool, brought in Netherlands No.1 Mark Flekken from Brentford to take the gloves, and added highly rated PSG youngster Axel Tape. Janis Blaswich has arrived from RB Leipzig to back up Flekken.

Why it matters: Quansah offers athletic recovery and ball-progression to replace some of Tah’s minutes, while Flekken stabilises the post-Hrádecký era. Tape is a longer-term project with elite tools; Blaswich would round out a deeper, more experienced keeper room.

Borussia Dortmund: Smart additions to support Kovac’s reset

What they did: Dortmund added Jobe Bellingham from Sunderland on a five-year deal to inject versatility and ball-carrying from midfield. (Up front, last summer’s big move Serhou Guirassy remains central after joining in 2024.) Niko Kovač continues to shape the squad after taking over in January.

Why it matters: Bellingham’s profile fits Kovač’s preference for transitional punch and press resistance between the lines, diversifying the supply into Guirassy while easing creative load on Brandt/Reus’ successors.

RB Leipzig: Reloaded on the flanks and in midfield

What they did: A classic Leipzig window: buy prime-age talent and elite prospects. Johan Bakayoko arrives from PSV on a long-term deal to replace lost wing output, Max Finkgräfe strengthens left-back, Ezechiel Banzuzi adds a CM option, and Serbia international Andrija Maksimović joins to develop at the six/eight.

Why it matters: Bakayoko’s directness plus Finkgräfe’s delivery should keep Leipzig dangerous in wide areas, while Banzuzi/Maksimović deepen the rotation behind Haidara/Seiwald which is key for sustaining a title-pace points haul through winter.

What’s at stake this season?

Champions League vs. European qualification

Germany has four automatic places in the 2025/26 Champions League league phase. The two extra “European Performance Spots” this year went to England and Spain, so the Bundesliga does not receive a fifth berth. Europa League and Conference League places are filled via league positions and the DFB-Pokal, with Germany’s allocation confirming two Europa League berths and one Conference League slot.

Qualifying for the Champions League is financially decisive. Under UEFA’s 2024–27 model, every club that reaches the league phase receives a starting fee of €18.62 million before any match or progression bonuses, with further payments tied to results and the new value pillar.

Financial sustainability and competitive equity

Domestic media income sets the baseline for club budgets. From 2025/26 to 2028/29, the DFL will distribute an average of €1.121 billion per season from German-language broadcast rights across the 36 clubs in the top two divisions, a slight increase on the previous cycle.

To spread that money fairly, the DFL kept its four-pillar distribution model for national media revenue: equal distribution, sporting performance, fan and media interest, and youth development. Bundesliga 2 retains a fixed 20 percent share, and from 2025/26 the “interest” pillar explicitly factors TV coverage and club membership.

Domestic prize money

Exact “prize money” is not published as a simple winners’ cheque. Instead, central TV distributions vary by club. For 2025/26, estimates show a first-division base amount of roughly €26 million per club, with performance and other pillars lifting the top clubs into the €70–80 million range for the season’s central payout.

Relegation and stability

The bottom two in the Bundesliga are relegated automatically, while 16th faces the third-placed team from Bundesliga 2 in a two-legged play-off. Dropping a tier means a sharp reduction in central income, since Bundesliga 2 receives a smaller share of the media pool under the DFL framework. Every point matters for sporting survival and financial planning.

UEFA coefficients and league reputation

Germany’s collective performance in Europe drives both prestige and future access. In 2024/25, England and Spain topped the one-season association coefficient table, which is why they claimed the two European Performance Spots for 2025/26. Sustained strong results by German clubs are essential to keep four automatic Champions League places and to contend for any future extra berth.

The role of Sportmonks in Bundesliga predictions

Sportmonks is more than a data feed. It is a full toolkit that blends real-time match data with historical context and predictive modelling, so your Bundesliga coverage can move from reactive to genuinely foresightful. Our Football API spans thousands of competitions worldwide and exposes the staples you need for Germany’s top flight: fixtures, standings, live scores, line-ups, odds and rich match stats.

Integrated data pipeline: from real-time to historical

You get high-frequency live updates for scores, events and fixtures, plus comprehensive historical endpoints for building models and previews. This lets you stitch live match moments to long-range trends in one workflow.

Bundesliga-ready building blocks

Because the Football API is league-agnostic but deep, it covers everything from schedules and tables to player, team and odds data that can power articles, dashboards or broadcast graphics for the German top tier.

Expected goals (xG) metrics

To evaluate performance beyond the scoreline, Sportmonks’ xG suite includes expected goals, expected goals on target, expected points and granular splits such as non-penalty xG, set-play xG, corners and free-kicks. These are available through dedicated xG endpoints for easy integration into previews and post-match analysis. Sportmonksdocs.sportmonks.com

Predictions API: Machine learning meets football logic

Pre-match probabilities for markets like match winner, correct score, over/under and BTTS are available via the Predictions API, with probabilities published ahead of kick-off and structured for programmatic use. The same framework also flags potential value opportunities relative to bookmaker prices.

Value bets and player-level insight

The Value Bet model processes historical odds and market movement to surface mispriced outcomes, refreshing frequently up to the start of a match. Meanwhile, the predictions stack can incorporate a player-contribution layer that accounts for form, role and influence, sharpening match forecasts.

Transfers and transfer rumours API for squad-change signals

Transfers: Get accurate and up-to-date information about each team’s activity in the transfer market with our Transfers API, delivering the latest insights on team movements.

Transfer rumours: Stay ahead of the game with our Transfer Rumours endpoints, providing structured speculation with fields like probability, source, and timeline. Filter by player, team, or date window to monitor stories that may impact model inputs before deals are confirmed, ideal for tracking squad volatility.

Built for easy integration and many use cases

Clear docs, quick-start guides and best-practice pages make it straightforward to wire Bundesliga data into apps, editorial pipelines, betting tools or fantasy experiences.

Who are the current favourites to win the Bundesliga title in 2025/26?

Market picture (right now): Most books still have Bayern Munich as clear favourites, with Borussia Dortmund, Bayer Leverkusen and RB Leipzig forming the chasing pack at longer odds. Recent aggregated prices put Bayern short odds-on, with Dortmund/Leverkusen next and Leipzig a touch further back.

Bayern Munich

Squad changes and impact

Bayern have doubled down on star power and stability. Luis Díaz arrived from Liverpool to turbo-charge the wings, while Germany international Jonathan Tah joined on a free to anchor the back line. Both moves address last year’s “two-deep” depth questions in wide attack and at centre-half.

Key players

Back-to-back Torjägerkanone winner Harry Kane remains the league’s most reliable finisher, and with Díaz supplying from the flank, Bayern’s spine is elite. Kane finished 2024/25 as top scorer again with 26 league goals.

Mid-season outlook

Under Vincent Kompany, Bayern found a clear identity and marched back to the title last spring; the continuity of that project plus summer reinforcements should keep them going through winter.

Why they’re contenders

Champions, the league’s most prolific No.9, and targeted upgrades in defence and on the wing. On paper, Bayern start a step ahead and the odds reflect it.

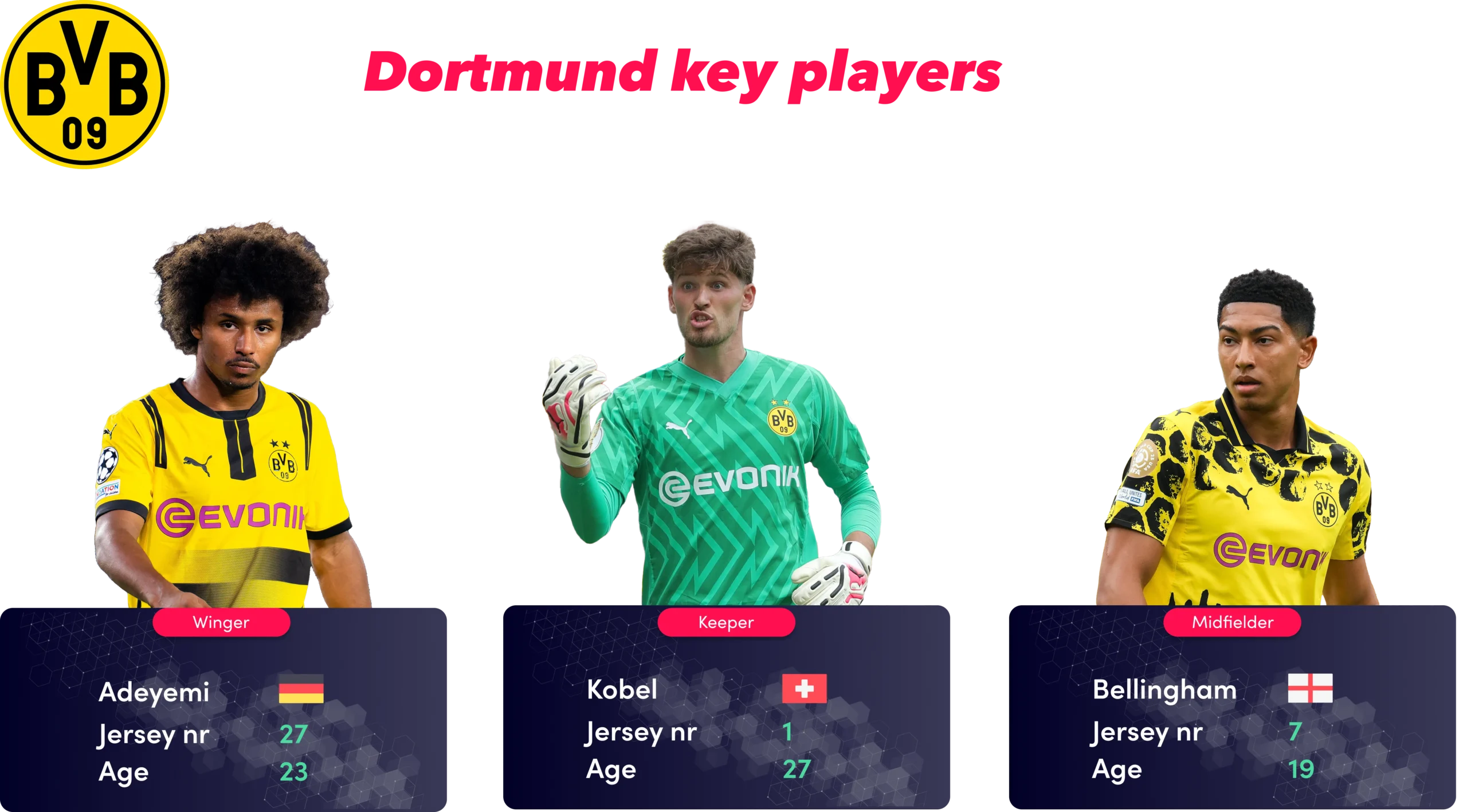

Borussia Dortmund

Squad changes and impact

Dortmund refreshed smartly: Jobe Bellingham arrived on a free to add vertical running and creativity to midfield, complementing last summer’s headline signing Serhou Guirassy up front.

Key players

Guirassy’s penalty-box threat plus Julian Brandt’s service gives BVB multiple routes to goal; if Jobe adapts quickly, their attacking ceiling rises.

Mid-season outlook

A full pre-season under Niko Kovač should harden BVB’s off-ball structure as his appointment in January began that reset. Expect a more stable block, fewer wild swings.

Why they’re contenders

There’s star power and depth, and the gap to Bayern is narrower if Kovač’s organisation sticks.

Bayer Leverkusen

Squad changes and impact

A changing of the guard. Erik ten Hag replaces Xabi Alonso, and key starters Florian Wirtz and Jeremie Frimpong have departed to Liverpool. Leverkusen responded by reshaping the core: Mark Flekken has come in to be No.1, with Janis Blaswich signed to back him up.

Key players

With creators leaving, greater responsibility falls on Victor Boniface and the new midfield blend to carry chance creation and finishing. Ten Hag’s structure must manufacture shots while the attack settles in. (Boniface, for his part, has signalled he’s staying).

Mid-season outlook

There will be teething issues as Ten Hag imprints his ideas and the new keeper unit settles. If the rebuild clicks by winter, Leverkusen can still live in Bayern’s mirrors.

Why they’re contenders

Last season’s champions (two years ago) still boast a deep squad and a coach with a high tactical floor; if the post-Wirtz creativity question is solved, they remain a live threat at mid-range odds.

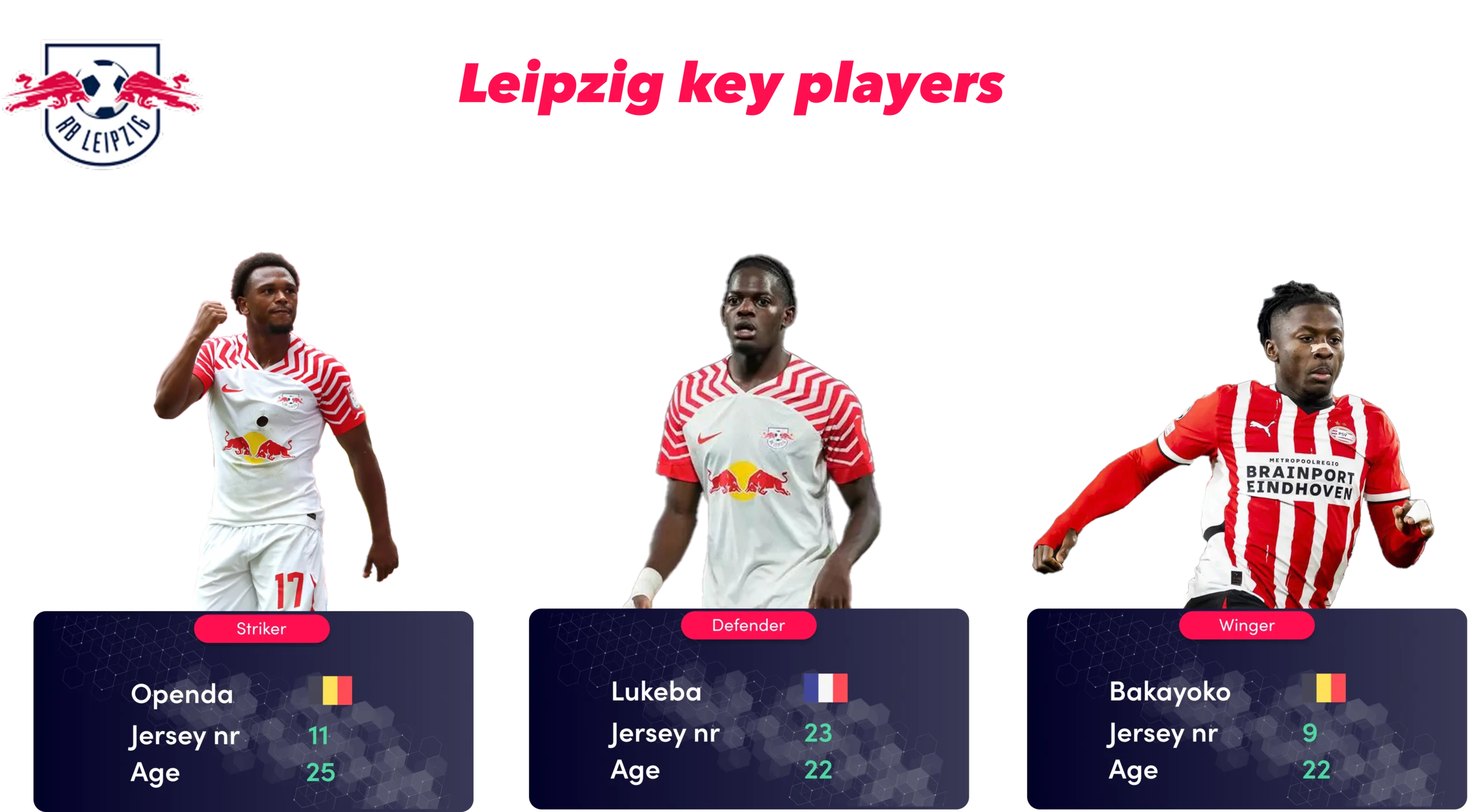

RB Leipzig

Squad changes and impact

Leipzig lost Benjamin Šeško to Manchester United, but moved aggressively to replace output and add width by landing Johan Bakayoko in a club-record deal. That recalibrates the attack toward dynamic wing play.

Key players

Dani Olmo’s multi-tool creativity pairs naturally with Bakayoko’s take-ons and cut-backs which Leipzig will now lean on to cover Šeško’s goals.

Mid-season outlook

A new coach in Ole Werner which ushers in a slightly different pressing/possession blend. If the finishing keeps pace with the chance creation, Leipzig can hang with the top three.

Why they’re contenders

Elite talent pipeline, upgraded wing threat, and a clean tactical slate; if Werner’s ideas take hold quickly, Leipzig’s “outsider” price offers upside relative to their underlying metrics.

How Sportmonks enhances predictions

Player contribution model

Sportmonks’ prediction stack is line-up aware and refreshes with new team information, so probability estimates react to who actually starts. Models are updated daily from the full historical database and re-calculate once confirmed line-ups are known.

Predictions API

Pre-match probabilities for markets such as match winner, correct score, over/under and BTTS are available up to 21 days before kick-off, generated by statistical and machine-learning methods. Endpoints let you fetch probabilities per fixture or in bulk for automation.

xG data API

Expected metrics provide a deeper read on team and player performance, including team-level expected goals and related breakdowns you can plug into previews, model features and form guides. Dedicated xG endpoints document parameters, includes and usage.

Dark horses to win the Bundesliga in 2025/26

Eintracht Frankfurt

Fresh off a third-place finish and a Champions League return, Frankfurt feel like the best “outside” shot. They’ve reloaded smartly after selling Omar Marmoush (January) and Hugo Ekitiké (summer): Germany international Jonathan Burkardt arrived from Mainz and Japan’s Ritsu Dōan joined from Freiburg, giving Dino Toppmöller pace and end-product on the break. It’s a refresh that keeps them relevant behind the headline contenders. Some books still price the Eagles well behind the big three/four.

VfB Stuttgart

Cup winners in May and buzzing with youthful talent, Stuttgart have the swagger of a team that can run hot for long stretches. Yes, they’ve moved pieces on like Serhou Guirassy left earlier, but they’ve supplemented the attack (e.g., Nick Woltemade last year, Deniz Undav leading the line) and kept Sebastian Hoeneß’s high-tempo identity intact. If the DFB-Pokal momentum carries into autumn, VfB become the classic “no one wants to play them” side.

SC Freiburg

Julian Schuster’s first full campaign delivered 5th place and Europa League football, achieved with ruthless efficiency (they finished fifth despite a negative goal difference). Even after Dōan’s departure, Freiburg’s structure and coaching continuity make them awkward opponents and perfect dark-horse material if the bigger squads juggle Europe poorly. Don’t be shocked if they hang around the top four picture deep into spring.

Power your Bundesliga predictions with Sportmonks

Ready to turn previews into predictions? Plug our Bundesliga endpoints, xG metrics and Predictions API into your workflow, and you’ll have live data, historical depth and modelled probabilities in one place. Explore the docs, spin up a free trial or free plan, and start building today.